‘Non-public-public partnerships using funding in Saudi Arabia’s booming staunch property market’

RIYADH: Non-public-public partnerships own turn into a cornerstone for attracting substantial funding to Saudi Arabia’s staunch property market over the previous 5 years, an authority has urged an trade dialogue board.

Amid Saudi Arabia’s force to bolster the deepest sector and foster sustainable partnerships for pattern, the characteristic of PPPs in spurring financial growth and innovation is now more severe than ever, delegates on the 15th Staunch Property Construction Summit Saudi Arabia – Europe edition were urged.

Saudi staunch property projects headlined the match held in Palma de Mallorca, Spain and hosted by GBB Venture. This gathering featured over 100 corporations and linked willpower-makers from major Saudi projects with world suppliers.

It also showcased the Kingdom’s swiftly staunch property inclinations, driven by mettlesome metropolis inclinations and substantial infrastructure investments, emphasizing sustainability and innovation.

Speaking on the match, Elias Abou Samra, CEO of Rafal Staunch Property, said: “We’ve considered apt traction on PPPs. With deepest-public partnerships, you own guaranteed offtake. So many of the investments that came into the nation were basically based utterly on this.”

In a panel dialogue titled “In Conversation with a Chief Challenger,” Abou Samra offered a classification map for PPPs in Saudi Arabia – structured and unstructured.

“It’s a definition that I came up with, alternatively it helps me brand the panorama of opportunities,” he said.

Structured PPPs embody projects under the Nationwide Center for Privatization, that are extremely organized and regulated. In distinction, unstructured PPPs involve mega projects esteem NEOM and Red Sea, characterized by joint ventures between public entities and deepest investors.

The NCP, is one amongst the federal government packages launched by the Council of Financial and Construction Affairs to function the objectives of Vision 2030.

This system seeks to improve the scheme of the national financial system, and enhance the characteristic of the deepest sector as neatly as make stronger the authorities’s focal level on its legislative and regulatory characteristic and glimpse to attract native and foreign order investments.

Loyal thru the dialogue, Abou Samra unveiled a wealth of opportunities looking out at for investors within the Saudi staunch property market, highlighting the $1.5 trillion figure talked about in a present advise by the US-basically based utterly world staunch property products and providers company JLL, which particulars the pipeline for onward projects within the Kingdom.

“This will seemingly be inclined to section this $1.5 trillion to fancy the panorama of opportunities available within the market out of the $1.5 trillion,” said Abou Samra.

“I deem $80 to $90 billion own already been awarded. So as that formulation there’s 15 times growth in phrases of projects to be done over the following seven, eight, per chance 10 years,” he added.

The CEO became once candid about the challenges faced by mega projects, acknowledging that they require time and in general stumble upon elements. “It’s no secret that these projects may per chance per chance moreover be stretched, but the relevance of these figures is to specialise within the size of opportunities. Whereas the Saudi authorities may per chance per chance moreover simply no longer invest the closing balance of $1.5 trillion within the shut to time-frame, there is vital traction from foreign order investments.”

Regional investors own already proven major hobby, a pattern Abou Samra considered as a wholesome ticket that will force further foreign order funding from every Western and Jap markets.

“(They) brand the intricacies of investing in Saudi Arabia, creating a ripple assassinate that fosters more substantial world funding,” he defined.

The explicit property market in Saudi Arabia is transitioning from fashioned infrastructure projects to more subtle superstructures and operational actions. This transformation is poised to flee up, significantly as most infrastructure works are already neatly underway. Abou Samra emphasised that this development is promising for industries corresponding to construction, daily life, tourism, and interior assemble.

Several initiatives are for the time being underway, in conjunction with the headquarters community, which has considered a rising collection of regional HQs exciting to Riyadh.

“As of my last check, 225 corporations own relocated their regional headquarters to Riyadh. This demonstrates the management’s commitment to interdisciplinary pattern and price introduction,” Abou Samra remarked.

Greater than 120 world corporations purchased licenses to relocate their regional headquarters to Saudi Arabia at some level of the major quarter of 2024, representing a 477 p.c year-on-year lengthen.

In its quarterly advise, the Kingdom’s Ministry of Funding revealed 127 permits issued within the major three months of the year, underscoring the nation’s beautiful and favorable industry ambiance.

Speaking on the predict of for residency in Saudi Arabia, the CEO emphasised that it stays strong, driven basically by native residents and increasingly more by expatriates who own made the Kingdom their house.

“I’ve launched the mission for the reason that starting up of this year, and nearly 15 p.c of the investors are expats that are residents. Some of them had been residing in Saudi for 10 or more years, so that they call it house. But until very no longer too long ago, they were no longer in actual fact wanting for a house,” said Rafal’s head.

This predict of is basically from Arabs and Southeast Asians, with doable growth in Western expatriates as community-driven projects esteem Dirriyah rob shape, he defined.

Saudi Arabia launched the premium visa residency possibility in 2019, aimed to enable eligible foreigners to live within the Kingdom and obtain benefits corresponding to exemption from paying expat and dependents fees, visa-free world lunge, and the staunch to have faith staunch property and streak a industry without requiring a sponsor.

Abou Samra also discussed the burgeoning mortgage trade in Saudi Arabia, which is catching up on misplaced years of low uptake. The Saudi Staunch Property Refinance Co., established by the Minister of Housing, aims to securitize and syndicate mortgage portfolios, creating liquidity available within the market.

This initiative is likened to the establishment of Freddie Mac and Fannie Mae within the US, basically based utterly on the CEO.

Different programs, corresponding to land deals with prolonged fee phrases, are being employed to decouple from debt markets amid anticipated turbulence. “We lovely won a mission that’s a pair billion riyals in price, but we may per chance per chance moreover launch with 150 million riyals of fairness, and here’s without debt,” Abou Samra shared.

He concluded with a call to motion for vendors and suppliers, emphasizing the importance of localization within the provision chain. “Localization is a will must own. I do know we’re talking to a crowd that’s largely vendors and suppliers from at some level of the arena, but my recommendation would be, salvage programs to localize your products,” he entreated.

The insights equipped by Abou Samra underscored the dynamic and evolving nature of the Saudi staunch property market, presenting a wealth of opportunities for investors and stakeholders.

Saudi Arabia’s staunch property sector is poised for substantial growth, with projections reaching $69.51 billion in 2024 and anticipated to surge to $101.62 billion by 2029. This growth aligns closely with the Kingdom’s Vision 2030, focusing prominently on housing, tourism, and industrial pattern.

Chief Working Officer of Armada Casa, Wassim Hamdanieh. Equipped

Chatting with Arab News on the sidelines of the match Wassim Hamdanieh, chief working officer of high-live construction cloth vendor Armada Casa, said his firm plans to place key partnerships to assassinate greater its premium construction materials portfolio.

“With Vision 2030 using swiftly growth, our focal level is on meticulous, issue-oriented inclinations that align with the nation’s metropolis and sustainability dreams, positioning us to shape the future of Saudi Arabia’s property panorama with unparalleled quality and innovation,” he said.

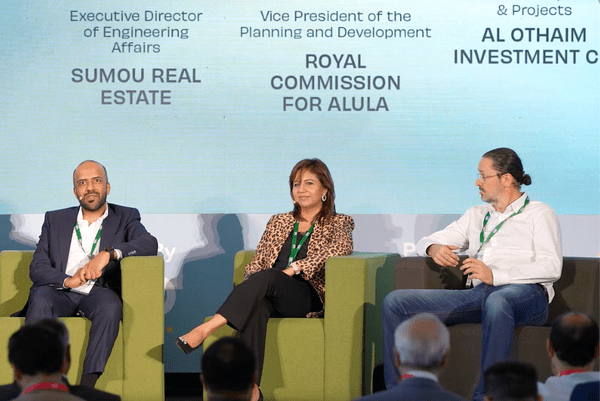

In any other panel dialogue, titled “Setting Saudi Above the Competing Boundaries,” Navdeep Hanjra, vp of planning and pattern on the Royal Price for AlUla, highlighted the large doable of the self-discipline.

“AlUla spans 22,000 sq. km., nearly the size of Belgium, and boasts magnificent landscapes and indispensable nature reserves. Its grasp plans showcase its specialty and diversity,” she said.

Hanjra elaborated on the 5 grasp plans, emphasizing the “Scramble Through Time,” which guides company from the used Nabataean period to Hegra, Saudi Arabia’s first UNESCO World Heritage dwelling.

The “Direction to Prosperity” grasp design aims to develop the present population from 44,000 to 222,000, reworking AlUla into a sustainable metropolis that balances tourism and community pattern.

Navdeep Hanjra, vice present of planning and pattern on the Royal Price for AlUla. Screenshot

The vp emphasised that 70 p.c of AlUla’s land is devoted to nature reserves, making trudge the preservation and regeneration of its ancient landscapes.

Essentially basically based on whether AlUla would remain a restricted tourist destination or launch up further, Hanjra defined that a structured framework design, developed 5 years ago, guides the self-discipline’s pattern.

This design involves particular metropolis pattern boundaries, customer targets, and 12 guiding rules centered on cultural and natural heritage, sustainability, and socio-financial elements.

These rules map to improve and own the present community while promoting sustainable pattern and re-naturalizing the panorama for future generations.

Leave a Reply