Journalist

- U.S CPI files rose to 0.3%, objective beneath the expected 0.4% in April.

- Market seen some relief after April’s boring inflation reading, with BTC jumping by +5%

Risk-on markets, including Bitcoin [BTC], seen some relief after United States’ CPI files published that inflation didn’t rep necessary worse in April.

Constant with the united statesBureau of Labor Statistics (BLS), CPI (Particular person Price Index) rose 0.3% in April, fairly lower than the expected 0.4%. CPI is a key files level for Fed rate selections and tracks what patrons pay for goods and products and services to gauge inflation.

If truth be told, the reading suggested that inflation cooled fairly in April, giving the markets a necessary-wanted breather after hundreds of muted imprint action.

Bitcoin swings, eyes the fast-duration of time provide at $65K

AMBCrypto objective no longer too long in the past lined how this week’s Fed calendar and higher macro occasions may possibly possibly per chance well affect BTC imprint action. The lower reading from the CPI boosted threat-on markets, with BTC leading the fray.

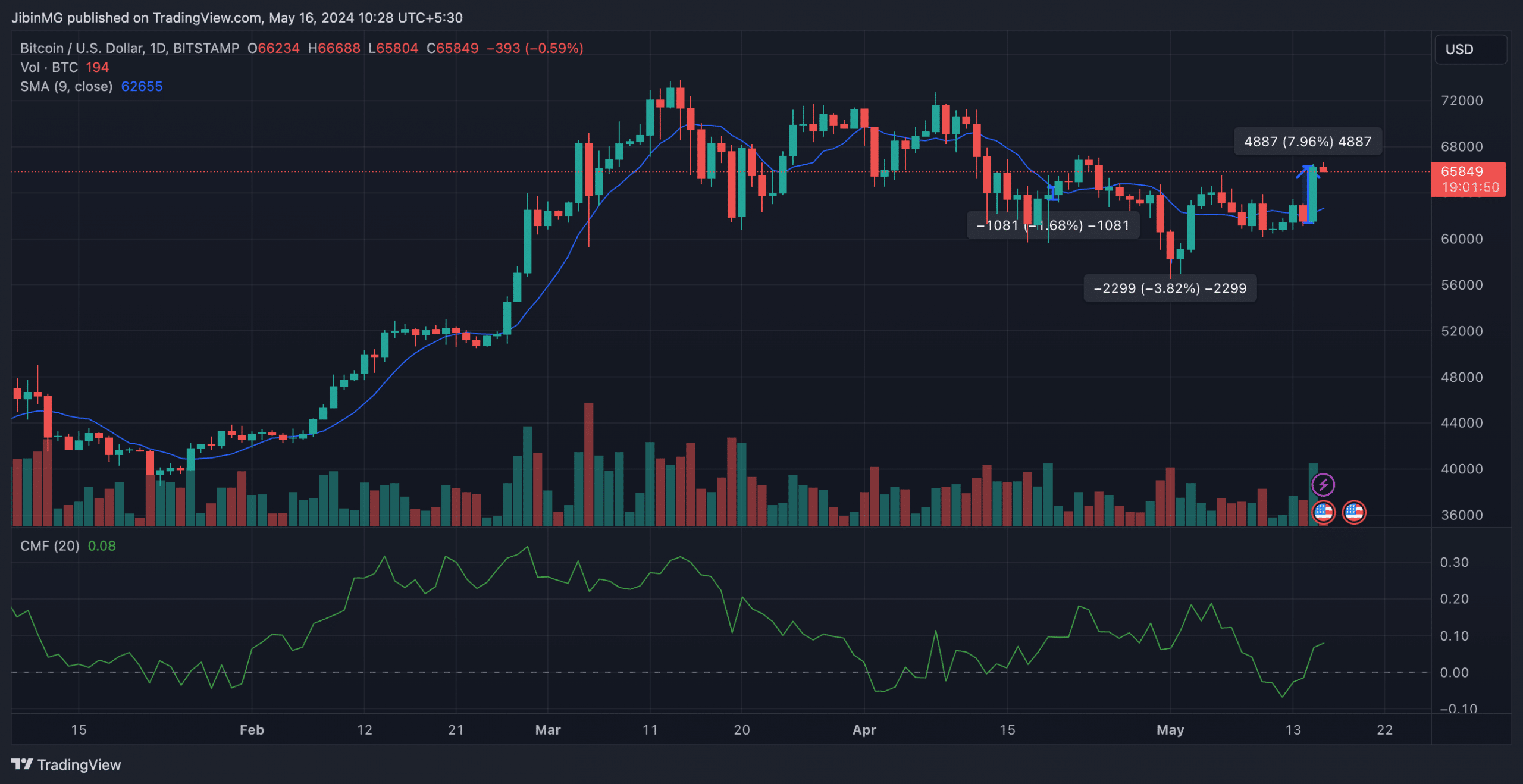

On the imprint chart, the king coin rallied by over 5% and cleared its fast-duration of time place provide (resistance) stage at $63k. On the time of writing, it used to be trading at a imprint smartly past $65,000.

The aforementioned transfer may possibly possibly per chance well flip BTC’s market structure to bullish on the lower timeframes (LTF), in particular on the 4H chart, if the candlestick closes above it. It’s worth noting, on the different hand, that the market structure on higher timeframes remains bearish except BTC decisively closes above $66k.

Pseudonymous crypto-dealer and analyst, Skew, shared a the same projection after the CPI files used to be launched. After Bitcoin most popular past $63,000, the dealer famed,

“Role provide around $65K now. Thin place books, so place taker waft would possibly be indispensable in uncover to pattern with bullish pricing to this level in threat assets”

Moreover, the dealer marked $63k and $63.5k as key imprint levels for a downside transfer.

Wait and see

Without reference to the marginally lower CPI reading, the Fed may possibly possibly per chance well await a confirmation of boring inflation sooner than reducing passion rates despite the indisputable truth that.

Since BTC’s imprint action is fixated on Fed rate expectations, a clear imprint course may possibly possibly per chance well be picked after June’s Fed meeting. In the meantime, BTC may possibly possibly per chance well lengthen its choppiness within the $60K—$70K range till the following Fed rate decision.

Leave a Reply